how much is insurance to pay off mortgage

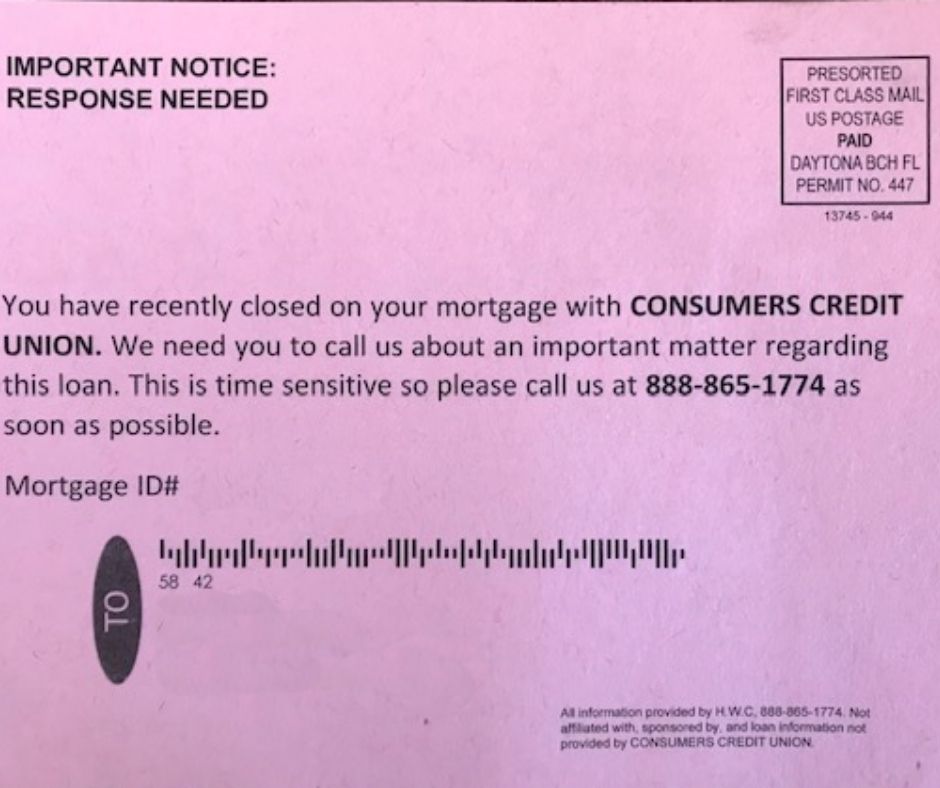

Scammers may use data from public sources to reach potential victims, such as in the example below. Scammers might want to take your cash, but a lot are also searching for your data to steal your identity, which means more than your money is at risk.

Mortgage life insurance is more expensive than the guaranteed level of term insurance. It's usually offered as a "Non-Medical" insurance product. Non-medical means you're not required to take an exam (including urine and blood samples) to be covered. The process for applying is simple. It's quick and straightforward to complete, requiring only a handful of health-related questions. Mortgage Life Insurance is usually offered in just two categories: Standard Tobacco and Non-tobacco.

how do i report mortgage fraud